The PPA refers to a private retirement scheme administrator as defined under Section 139A of the CMSA. Secondly PRS is privately run by financial institutions with no guaranteed returns unlike the government-owned EPF which guarantees you a minimum dividend rate of 25 a year.

Great New 好消息 Public Mutual Mrs Life Planner Facebook

Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your.

. Right now is a good time to revisit your retirement savings plan to help you stay on track for a more financially secure future. Did you know that your money in Private Retirement Scheme PRS is protected from creditors. At Public Mutual we provide a wide range of PRS funds that you may choose to contribute to based on your contributon time horizon risk appetite and age.

The Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. Public Mutual PRS Islamic Strategic Equity Fund. Private Retirement Scheme known as PRS for short is a long-term savings plan which allows you to voluntarily contribute and build up your retirement fund.

The duties and responsibilities of the PPA under the law Section 139H of CMSA include taking into account public interest considerations in acting in the best interests of members and having regard to. Make A Plan Today To Help Boost Your Retirement Savings. Public Mutual PRS Islamic Growth Fund.

Ad Contact Mariner Wealth Advisors for Help Planning Your Retirement. Planning for college doesnt have to feel like homework. 146 Likes 0 Comments - Public Mutual Berhad invest_with_public_mutual on Instagram.

Public Mutual Private Retirement Scheme Shariah-based Series Scheme Trustee. For starters PRS is a voluntary contribution scheme where you can contribute as little or as much as you want. RHB Investment Management Sdn.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. What is Private Retirement Scheme PRS. Additional Retirement Nest Egg Acts as an additional nest egg besides EPF to accumulate sufficient retirement savings Flexible and Affordable.

Pelepasan cukai sehingga RM 3000 dengan pelaburan PRS Perlindungan Takaful PERCUMA untuk ahli PRS Public Mutual. Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. Learn how we can help you.

Business retirement plans PFS Investments 401k 403b and 457b plan offerings are individual and employer-sponsored retirement plans that grant employees the opportunity to contribute a portion of their salary on a tax-deferred basis into investment vehicles such as mutual funds and annuities. What is a Private Retirement Scheme PRS. Find Out How We Can Help You Sustain Income Throughout Retirement.

PRS is a voluntary investment scheme to help you save for retirement. Public Mutual PRS Islamic Conservative Fund. Under the scheme you can invest in approved unit trust funds that are managed by PRS providers Public Mutual Kenanga etc.

Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. Years since 1945 that we have been providing retirement and investment services. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators.

AmanahRaya Trustees Berhad Public Mutual PRS Islamic Conservative Fund PRS-ICVF Other Self Selection Public Mutual PRS Equity Fund PRS-EQF Public Mutual PRS Strategic Equity Fund PRS-SEQF Public Mutual PRS Islamic Strategic Equity Fund PRS-ISEQF. Currently I have saved in my childs college fund. Public Mutual has been managing funds for more than 30 years and is committed to consistently deliver above average medium- to long-term returns for all its funds.

P ublic Mutual is the largest private unit trust company in Malaysia. Wide Range of Investment Choices Access to Smart Tools Objective Research and More. Dilancarkan pada 18 Julai 2012 PPA merupakan sebuah badan yang diluluskan oleh Suruhanjaya Sekuriti Malaysia SC untuk melindungi kepentingan ahli PRS dan mendidik orang ramai tentang PRS.

The Private Pension Administrator Malaysia PPA serves as the central administrator of PRS. Ad With A 3 Minute Chat Take Charge of Your Retirement And Plan Your Future Income. A voluntary contribution scheme A vehicle to accumulate savings for retirement Complements contributions made to Employees Provident Fund EPF Why Contribute to PRS.

Public Mutual Private Retirement Scheme -Shariah-based Series. Maximum once a year from Sub-Account B unless permanently leaving the country. MassMutual offers life insurance and protection products retirement and investment services to help you meet your financial goals.

Dedicated salaried employees providing the service and support you need. 30 Januari 2018 Public Mutual Private Retirement Scheme PRS Shariah-based Series Public Mutual Skim Persaraan Swasta PRS Siri Berlandaskan Syariah Public Mutual PRS Islamic Growth Fund Public Mutual. Public Mutual PRS Islamic Moderate Fund.

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Awards Celebration Campaign 2022

Prs Funds Information Private Pension Administrator Malaysia Ppa

Public Bank Berhad Unit Trust Private Retirement Scheme

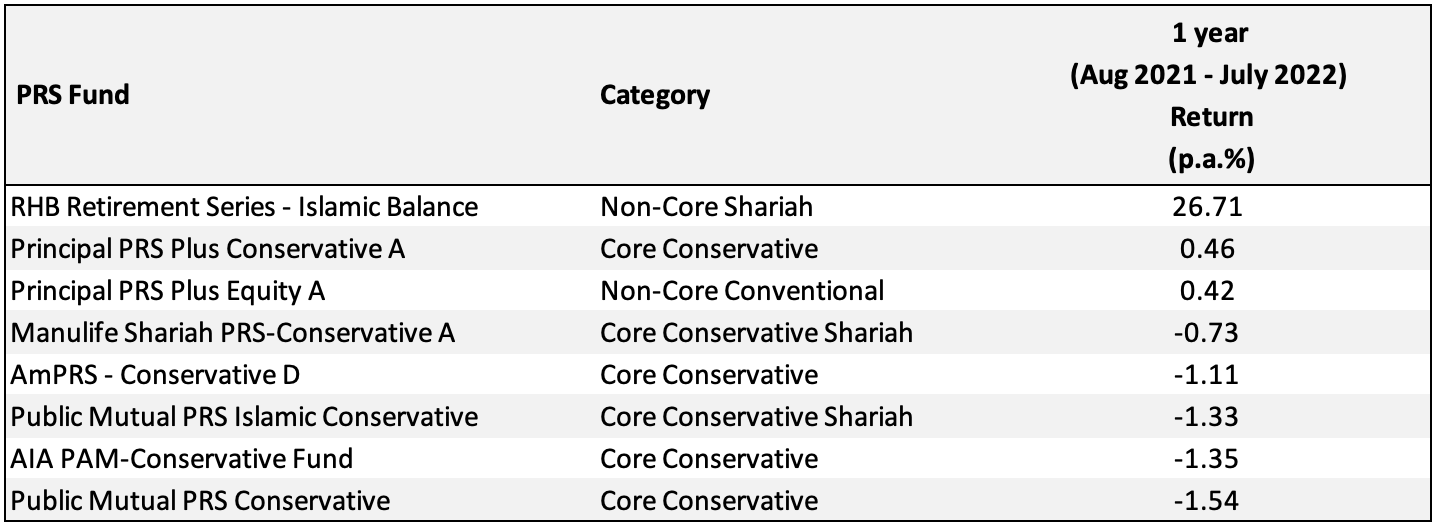

Which Prs Funds To Invest In 2020 2021 Mypf My

Unit Trust Consultant Public Mutual Home Facebook

A Guide To The Private Retirement Scheme Prs

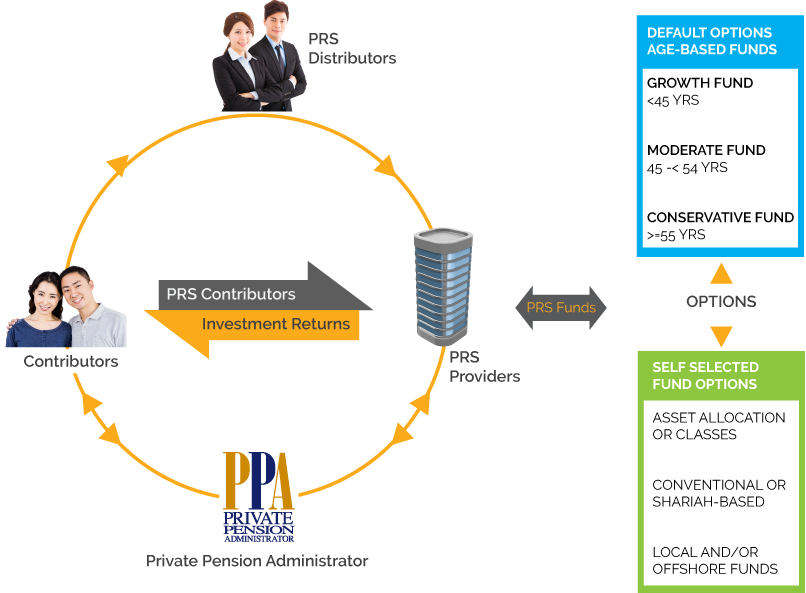

Structure Of Prs Private Pension Administrator Malaysia Ppa

Prs Provider Public Mutual Berhad Private Pension Administrator Malaysia Ppa

5 Best Rrsps In Canada 2022 Top Savings Rates Banks And Brokers

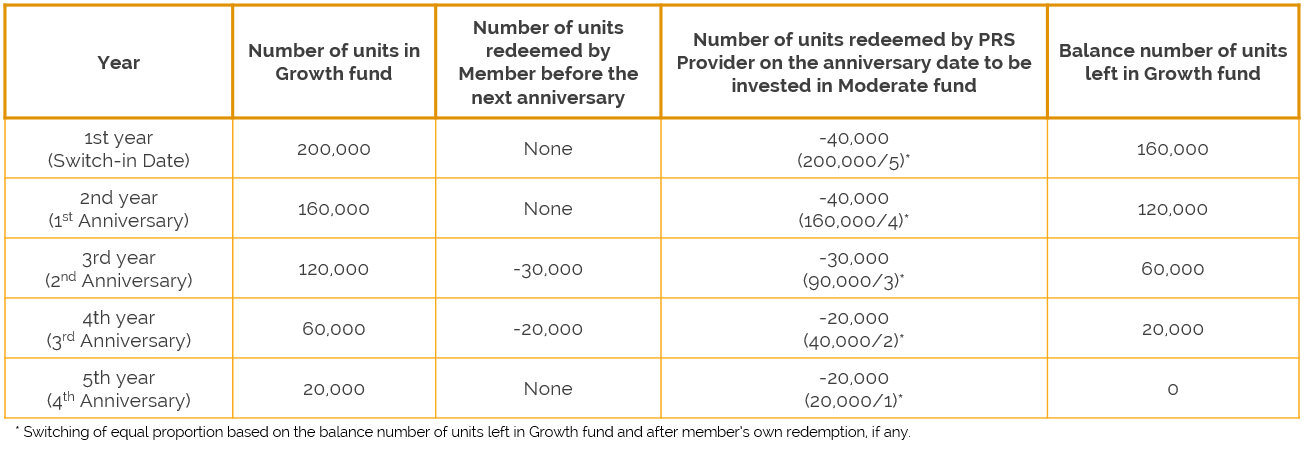

Structure Of Prs Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa